ESG due diligence plays a central role in how companies manage risk, transparency and trust across their value chains.

For sustainability, compliance, and legal teams working in mining, metals, battery materials, and critical minerals, this work often spans multiple frameworks, counterparties, and regulatory expectations.

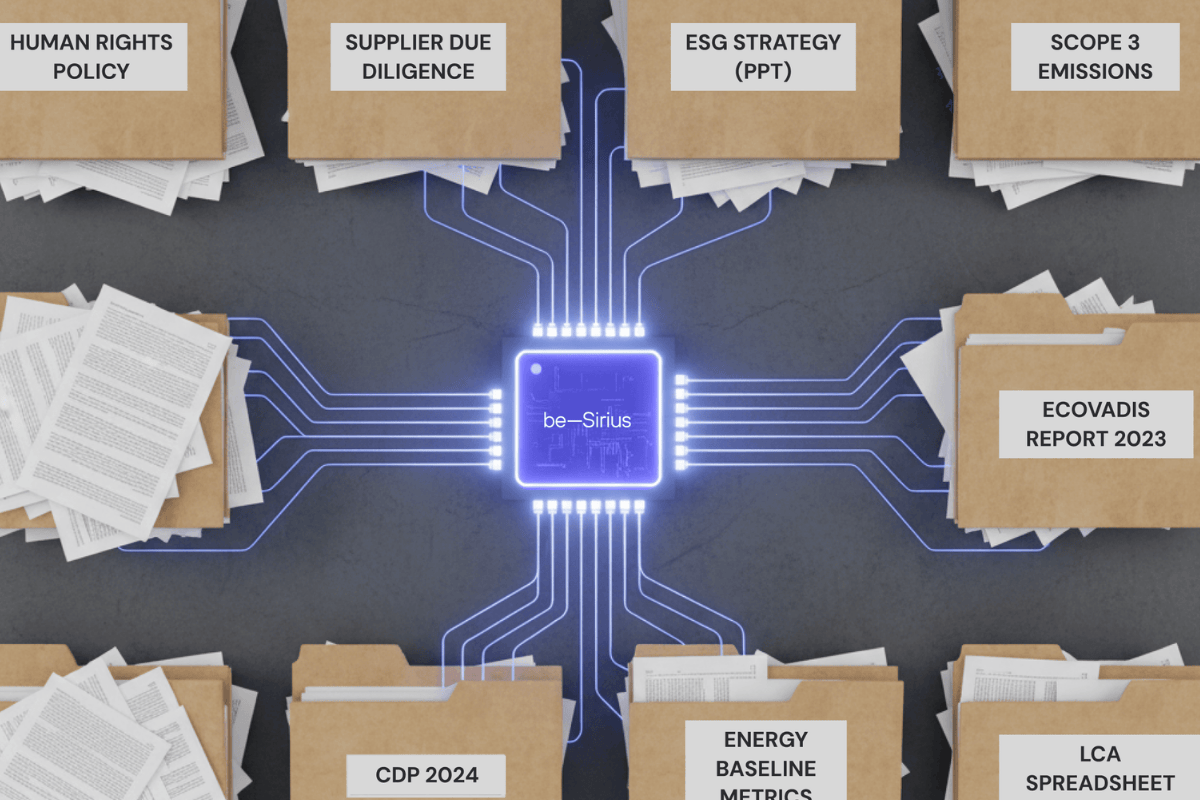

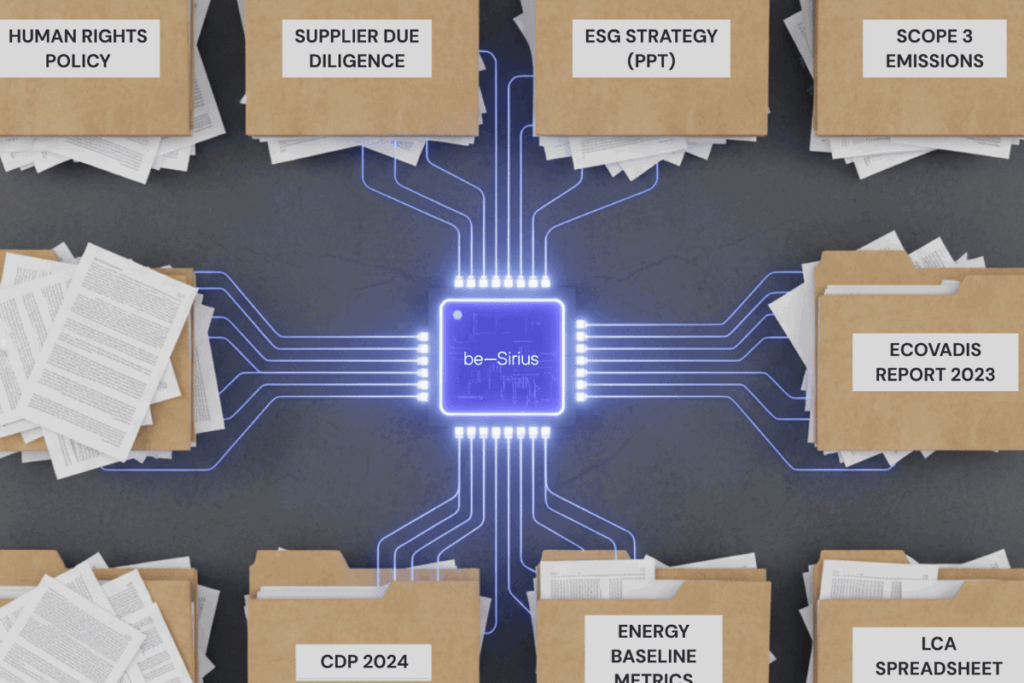

As reporting requirements evolve and customer expectations increase, teams are asked to assess the same organizations repeatedly, each time through a slightly different lens. The challenge is rarely a lack of information. More often, it is the effort required to organize, interpret and reuse that information consistently. This is the context in which the beSirius Due Diligence module was developed.

Building reusable sustainability intelligence

The beSirius approach is based on a simple idea.

Sustainability intelligence becomes more valuable when it can be reused.

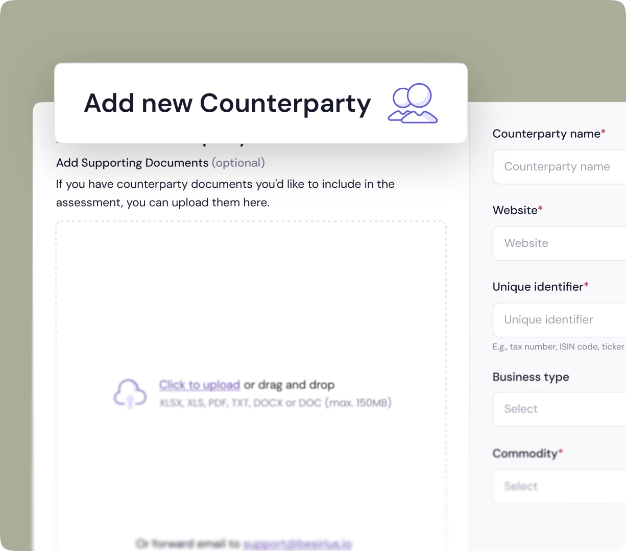

Instead of treating each due diligence request as a separate exercise, teams create a structured and continuously updated profile of a company, known as the Sustainability Twin™.

The Sustainability Twin™ integrates existing policies, audits, certifications, reports, and public disclosures, with a strong focus on industrial and materials value chains. Information is structured once and maintained as disclosures evolve over time.

Each Sustainability Twin™ then serves as a shared foundation for future assessments across frameworks, customers and internal reviews.

Running multiple types of due diligence from one foundation

With a Sustainability Twin™ in place, teams can run different types of ESG due diligence using the same underlying data and evidence.

- Supplier assessments

Supplier sustainability performance can be evaluated across regions, commodities and risk categories using criteria aligned with internal policies and regulatory requirements. Documentation is reviewed efficiently, risks become visible across large supplier portfolios, and follow ups are triggered where clarification or additional evidence is needed.

- Customer assessments

The same structured approach applies to customer and counterparty assessments. Teams define their own evaluation criteria, maintain traceable documentation for each decision, and support onboarding as well as ongoing monitoring with consistent logic.

- Partner and any third party assessments

Sustainability assessments can also be extended to partners, contractors and strategic relationships. Documentation and decisions are centralized, performance is tracked over time, and assessments remain aligned with internal ESG requirements.

Across all assessment types, the underlying data remains consistent and reusable.

Supporting complex industry and regulatory frameworks

Many due diligence frameworks in industrial supply chains involve large numbers of criteria and detailed performance levels. beSirius is designed to support this complexity.

Teams use the platform for industry and regulatory frameworks such as the GBA Benchmark, EU Battery Regulation, OECD Due Diligence, ICMM, TSM, IRMA and Copper Mark.

For Global Battery Alliance style assessments, the system supports more than one thousand criteria and visualizes results using portfolio heat maps aligned with A, AA and AAA performance levels.

beSirius has been an official member of the Global Battery Alliance since 2025.

A key advantage for teams is the ability to reuse the same evidence across multiple frameworks, reducing repetition for both internal teams and counterparties.

Evidence-based decisions with a clear audit trail

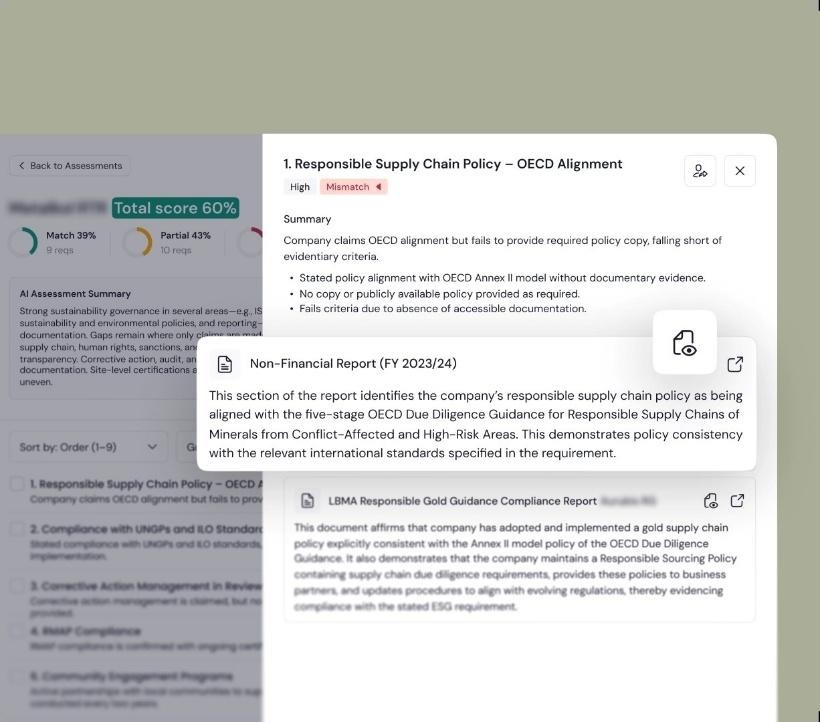

Every assessment outcome is supported by traceable documentation.

Evidence is linked directly to individual criteria, decisions remain transparent, and a full audit trail is maintained for internal governance and external review.

When additional information is required, follow up questions are managed directly through the platform. Communication remains structured, responses are linked to specific criteria, and teams can focus their expertise where judgment is required.

Portfolio level visibility and performance overview

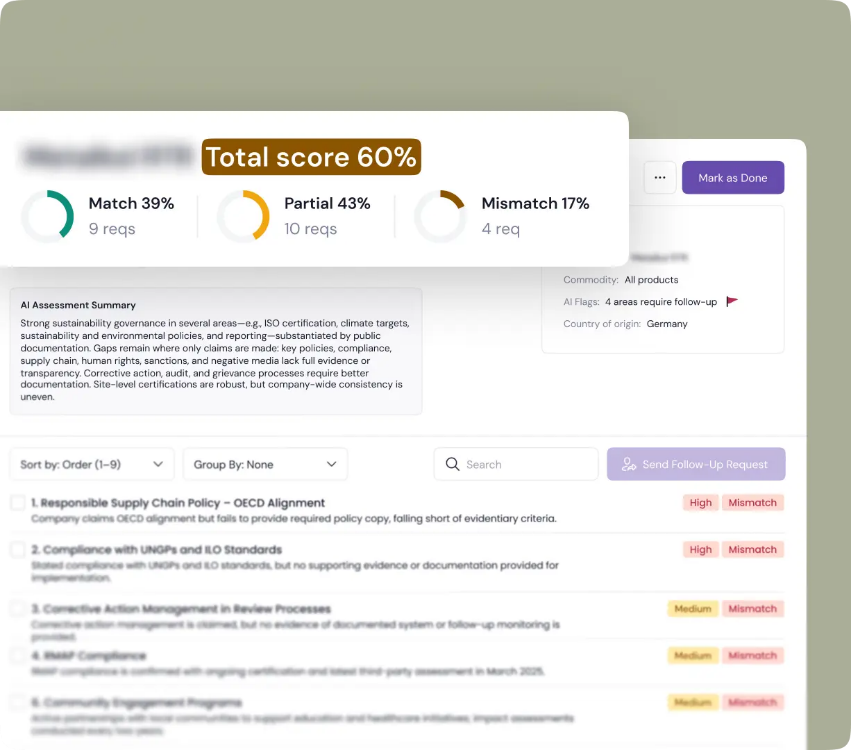

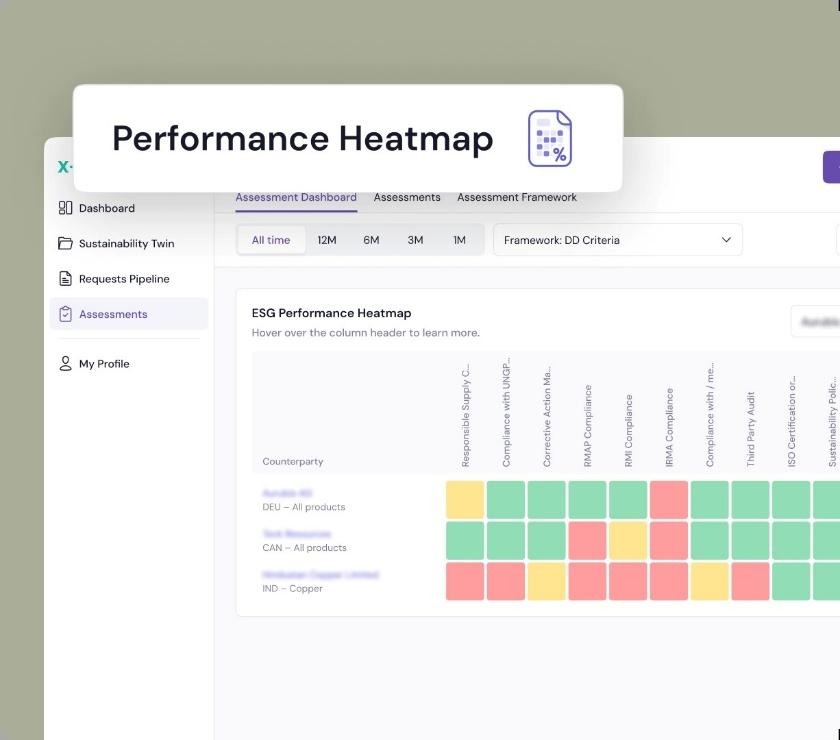

Beyond individual assessments, teams gain a portfolio-level view of sustainability performance.

Performance overviews make it possible to compare suppliers, customers or partners at a glance, while drill-down views connect scores to specific criteria and supporting evidence.

Heat maps highlight patterns across regions, commodities or counterparty types, helping teams prioritize review efforts and discussions.

This portfolio perspective supports more informed decision making and ongoing risk management.

How does this approach changes day to day work

Teams working with reusable sustainability intelligence experience clear operational benefits.

Assessments are completed more efficiently, with expert time focused on interpretation and risk rather than document handling. Evaluation logic remains consistent across counterparties. Portfolio level insights support prioritization. Supplier engagement becomes more structured and focused.

In many organizations, a significant share of expert effort has historically been spent on collecting, reviewing and reconciling documentation. Centralizing and reusing evidence allows that effort to shift toward analysis and action.

Who this approach is designed for

This approach is used by:

- Sustainability teams managing supplier and value chain assessments

- Compliance and legal teams responsible for due diligence and audit readiness

- Sourcing and procurement teams overseeing supplier onboarding and evaluation

- Finance teams supporting risk oversight and disclosures

It is especially relevant for organizations operating in critical minerals, battery materials, mining and metals value chains.

A structured approach to ESG due diligence

By treating sustainability data as a shared and reusable foundation, teams can support multiple due diligence needs with greater consistency and clarity. As frameworks evolve and expectations grow, this approach helps organizations maintain alignment across stakeholders while focusing effort where it delivers the most value.

FAQ

1) What is ESG due diligence?

ESG due diligence is a structured process to evaluate an organization’s environmental, social, and governance risks, controls, and performance using evidence such as policies, audits, certifications, and disclosures. It supports risk management, compliance, transparency, and trust across the value chain.

2) Why do companies repeat ESG assessments so often?

Because different customers, frameworks, and regulations ask for similar information in different formats. The challenge is typically not data availability, but organizing, interpreting, and reusing evidence consistently across repeated requests.

3) What is a Sustainability Twin™?

A Sustainability Twin™ is a structured, continuously updated profile of a company that consolidates ESG evidence—policies, audits, certifications, reports, and public disclosures—into a reusable foundation for assessments across multiple frameworks and stakeholders.

4) How does reusable sustainability intelligence reduce workload?

By structuring evidence once and maintaining it over time, teams can reuse the same documentation across frameworks and counterparties. This shifts effort away from repetitive document handling toward analysis, judgment, and action.

5) What types of ESG due diligence can be supported from the same foundation?

A single Sustainability Twin™ can support:

- Supplier assessments (onboarding, monitoring, risk triage)

- Customer and counterparty assessments (consistent onboarding and ongoing checks)

- Partner, contractor, and other third-party assessments (centralized evidence and decisions)

6) How are decisions kept evidence-based and audit-ready?

Each assessment outcome is linked to traceable documentation at the criterion level. This creates a clear audit trail for internal governance and external review, and keeps follow-up questions tied to specific criteria.

7) Can this approach support complex regulatory and industry frameworks?

Yes. Industrial and materials value-chain frameworks often have detailed criteria and maturity levels. A reusable evidence base helps teams map the same documentation to multiple frameworks and reduce repetition.

8) What portfolio-level insights can teams get from ESG due diligence?

Teams can compare performance across suppliers/customers/partners, view patterns by region or commodity, and drill down from scores to underlying criteria and supporting evidence. This enables prioritization and ongoing risk management.

9) Who typically owns ESG due diligence in organizations?

Common owners include sustainability teams, compliance and legal teams, procurement/sourcing teams, and finance/risk teams—especially in mining, metals, battery materials, and critical minerals value chains.

10) What information is usually required to run an ESG assessment?

Typical evidence includes ESG policies, audit reports, certifications, sustainability reports, public disclosures, and responses to follow-up questions, all linked to specific criteria and performance expectations.